What Is Metall-Seed-Signer: Offline Bitcoin Security

Cold storage using a durable metal backup is a pragmatic response to the real threat landscape facing Bitcoin holders. At a technical level, the product combines the conceptually simple but cryptographically powerful seed phrase – usually a BIP39 mnemonic - with an offline, fire- and corrosion-resistant medium that resists common physical failure modes. As a 12‑word BIP39 seed encodes 128 bits of entropy (roughly 3.4×1038 possible keys) and a 24‑word seed encodes 256 bits (on the order of 1.16×1077 possibilities), preserving that string intact is the single most important operational-security step for noncustodial Bitcoin ownership. Moreover, when used in concert with an air-gapped signing workflow and standards like BIP32/BIP44 key derivation and PSBT (BIP174) for transaction construction, a metal seed backup helps separate signing credentials from online attack surfaces, reducing exposure to malware and remote compromise.

Context matters: institutional custody and regulated custodians have grown in market share, yet survey and on‑chain trends show a sustained and vocal movement toward self‑custody among retail and high‑net‑worth holders. With over 19 million Bitcoin already in circulation, long‑term holders treating BTC as a scarce, inflation‑resistant asset increasingly layer physical redundancy into their risk models. Metall‑Seed‑Signer insights emphasize that this approach is not a panacea – it mitigates remote exfiltration but does not remove risks like physical theft, coercion, or single‑point failures. Therefore, prudent practice blends several defenses; such as, adding a BIP39 passphrase (also called a 25th word) or deploying a multisignature configuration distributes trust, while regulatory developments pushing custodial KYC/AML requirements make self‑custody and verifiable, offline backups more attractive for users prioritizing privacy and control.

For readers seeking actionable guidance,treat redundancy and verifiability as operational imperatives. In practice:

- Use a hardware wallet for key generation and signing; record the mnemonic on a metal backup rather than paper;

- Create at least two geographically separated metal backups, and routinely verify recoverability on a test wallet with a small amount of BTC;

- Consider advanced options-multisig, SLIP‑0039/Shamir, or BIP85 derived seeds-to avoid a single point of failure.

Transitioning from theory to example, newcomers should begin with a 24‑word seed and a single reputable hardware wallet combined with a metal backup, while experienced custodians should integrate air‑gapped PSBT workflows, periodic recovery drills, and documented contingency plans that account for legal and physical risks. Taken together, these measures reflect best practices in the current market: they acknowledge regulatory pressure on custodians, leverage cryptographic standards, and prioritize long‑term access to private keys without resorting to hyperbolic claims about invulnerability.

How the Metall-Seed-Signer Works – Air‑gapped Seed Storage and Transaction Signing

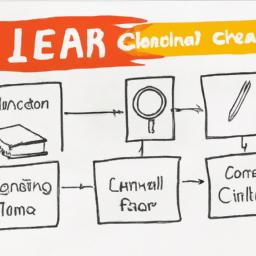

At its core, the system separates the source of truth-the seed phrase that controls your private keys-from any networked device, implementing a true air-gapped workflow. In practice, that means the seed is recorded and protected on a durable metal backup and the signing device never connects to the internet; instead, the online wallet constructs an unsigned transaction (a PSBT, per BIP‑174) which is transferred to the air‑gapped signer via QR code, microSD or other non-networked medium.The signer derives the appropriate private keys using standard derivation schemes (BIP‑39 / BIP‑32 / BIP‑44/84/86 as applicable), signs the PSBT, and returns the signed artifacts to the online wallet for broadcasting. By keeping private keys isolated from hot endpoints, this architecture mitigates the most common attack vectors-malware keyloggers, remote exploits, and phishing-becuase signing occurs in a controlled, offline environment and only the signed transaction (not the seed or private keys) ever touches the connected device.

Moreover, the design aligns with evolving market and protocol trends: as Taproot and advanced multisig schemes see broader adoption, users demand signers that support modern script types and descriptor‑based management to maintain interoperability with wallets and explorers.Transitioning from legacy single‑key custody to multi‑party or descriptor workflows can reduce counterparty risk; for example, a 2‑of‑3 multisig configuration can substantially lower the probability of total loss due to a single compromised key. At the same time, regulatory pressures-such as increased KYC/AML attention on custodial services-have nudged some users back toward self‑custody, boosting interest in robust cold‑storage solutions. Consequently, tools that combine metal seed durability with air‑gapped PSBT signing strike a balance between operational security and compatibility with mainstream wallets and exchanges.

For practical use, follow these actionable steps and precautions:

- Seed generation and backup: generate the seed on the air‑gapped device, engrave or punch it into a corrosion‑resistant metal plate, and verify by conducting a test restore on a separate device using only the metal backup.

- Signing workflow: create the unsigned transaction in your online wallet, export the PSBT, import it to the air‑gapped signer to sign, then re‑import the signed PSBT for broadcast-never type or photograph the seed.

- Advanced protections: use a passphrase (BIP‑39 passphrase) as an additional secret only when you understand the recovery tradeoffs, and prefer multisig for large holdings to distribute risk.

Transitioning between novice and expert practices, newcomers should focus on reproducible backups and one test recovery, while experienced users should integrate firmware verification, reproducible builds, and geographically distributed metal backups (such as, a safe deposit box plus a home safe). remember that no system is infallible: maintain operational procedures, update your threat model as market and regulatory conditions change, and treat an air‑gapped signer as one element in a layered security strategy for protecting Bitcoin and other crypto assets.

Why It Matters: Privacy, Resilience, and Best Practices for Long‑Term Bitcoin Custody

Long-term custody starts with understanding that control over a private key is control over the Bitcoin itself. As every on‑chain transaction cryptographically references keys stored off‑chain,custody decisions directly effect privacy and resilience: a single compromised key can deanonymize and liquidate holdings,while poor storage can mean permanent loss. Consequently, privacy techniques such as coin control, CoinJoin or native Taproot spending patterns help reduce address linkage and surveillance, but they come with trade‑offs-CoinJoin can draw regulatory attention in some jurisdictions and Taproot changes the inspection surface for chain analytics. Simultaneously occurring, physical resilience matters: combining an air‑gapped signer (for example, open‑source projects and devices like SeedSigner) with a metal seed backup (insights from the Metall‑Seed‑Signer approach) hardens holdings against theft, fire, and data rot while keeping keys off internet‑connected systems.

Moving from theory to practice, sound custody for the long term is procedural and layered rather than single‑tool dependent. Newcomers should begin with a reputable hardware wallet, a verified seed phrase writen to a certified metal backup, and a clear recovery plan stored in at least two geographically separated secure locations. Experienced holders should consider a multisig setup-using self-reliant key‑signers across different vendors and key types (hardware wallet, air‑gapped signer, and a secure mobile signer) or applying Shamir or SLIP‑0039 splitting-to eliminate single‑point failures. Actionable steps include:

- use a cold, air‑gapped device to sign large or infrequent transactions;

- Store the seed on non‑corroding metal plates and test restorations on an expendable device;

- Employ watch‑only wallets for daily balance checks and avoid exposing signing keys;

- Keep firmware updated and validate vendor firmware signatures before upgrades.

These measures improve survivability against physical disasters and operational errors while preserving usable access when markets move.

custody choices should reflect current market and regulatory realities: institutional custody products and exchanges now hold a material portion of tradable Bitcoin-creating counterparty concentration-while major failures such as Mt. Gox and FTX illustrate the systemic risk of trusting third parties. At the same time, regulators worldwide are increasingly requiring KYC/AML and transactional transparency under frameworks like the FATF travel rule, so privacy techniques must be balanced with legal compliance. Given Bitcoin’s history of deep drawdowns (bear markets of roughly 60-80% from peaks have occurred) and episodic liquidity events, long‑term holders should separate custody strategy from trading strategy: keep a core holding in well‑protected cold storage and a separate, smaller hot wallet for active use. In short, self‑custody offers meaningful benefits-reduced counterparty risk and greater control-but it also imposes responsibilities that, if managed with layered security, proper documentation, and awareness of evolving market and regulatory trends, can preserve value across cycles.

As Bitcoin custody continues to shift from custodial services back into individual hands, tools like Metall‑Seed‑Signer illustrate a practical, low‑tech approach to a high‑stakes problem: keeping seed phrases both safe and private. By combining a straightforward, air‑gapped hardware workflow with durable, offline storage of recovery seeds, the device aims to reduce exposure to remote attacks and surveillance while preserving user control.

That said, no single device is a silver bullet. Security depends on correct setup, sourcing hardware from trusted channels, protecting the physical device and backups from theft or environmental damage, and understanding your personal threat model.Complementary practices – such as testing recovery procedures, using multisignature setups for larger balances, and keeping firmware and verification tools up to date - remain essential.

For readers evaluating offline custody options, Metall‑Seed‑signer is worth considering as part of a layered security strategy. Educate yourself on how it fits your needs, compare it to other cold‑storage methods, and, when in doubt, consult reputable guides or security professionals before moving important funds.