What are the benefits of using the HODL strategy for Bitcoin investing?

The HODL Strategy: A Comprehensive Guide to Bitcoin Investing – Learn How to Maximize Your BTC Profits!

Bitcoin has become one of the most popular investments in recent years, and with its increasing popularity, more and more people are looking to maximize their profits from investing in the cryptocurrency. The HODL strategy is one of the most popular strategies for investing in Bitcoin, and this comprehensive guide will provide you with all the information you need to understand the strategy and maximize your BTC profits.

What is the HODL Strategy?

The HODL strategy is a long-term investment strategy that involves buying and holding Bitcoin for an extended period of time. The strategy is based on the idea that the price of Bitcoin will increase over time, and that by holding onto your Bitcoin for a long period of time, you will be able to maximize your profits. The strategy is also known as “buy and hold”, and it is one of the most popular strategies for investing in Bitcoin.

How to Implement the HODL Strategy

Implementing the HODL strategy is relatively simple. All you need to do is buy Bitcoin and hold onto it for an extended period of time. It is important to remember that the price of Bitcoin can be volatile, so it is important to be patient and not panic if the price drops. It is also important to remember that the price of Bitcoin can increase significantly over time, so it is important to be patient and not sell too early.

Price Data Statistics

In order to understand the HODL strategy and maximize your profits, it is important to have access to accurate and up-to-date price data. The Blockchain Explorer is a great resource for accessing price data statistics. The Blockchain Explorer provides detailed information about the current price of Bitcoin, as well as historical price data. This data can be used to analyze the performance of Bitcoin over time and make informed decisions about when to buy and sell.

Technical Analysis

In addition to price data statistics, it is also important to understand the technical aspects of Bitcoin investing. Technical analysis is the process of analyzing the price movements of Bitcoin in order to make predictions about future price movements. Technical analysis can be used to identify trends and make predictions about when to buy and sell Bitcoin. There are a number of tools and resources available to help with technical analysis, such as TradingView and Investing.com.

Conclusion

The HODL strategy is a popular strategy for investing in Bitcoin, and it can be a great way to maximize your profits. In order to successfully implement the strategy, it is important to have access to accurate and up-to-date price data, as well as an understanding of the technical aspects of Bitcoin investing. By following the advice in this guide, you should be able to maximize your profits from investing in Bitcoin.

Bitcoin has become an increasingly popular form of investment and is now seen as a potential hedge against inflation. For those looking for a reliable, long-term strategy, the HODL strategy is an option worth considering. Whether you’re a novice investor or an experienced financial trader, this guide explores the basics of the HODL strategy and how you can use it to make the most of your Bitcoin investments.

1. What is the HODL Strategy?

The HODL strategy is a popular way for cryptocurrency investors to manage their portfolios. It’s simple: you buy crypto and you hold it for the long term, no matter what the market conditions may be. The acronym originated from a Bitcoin forum post in 2013, when a member wrote “I AM HODLING” instead of ‘holding.’

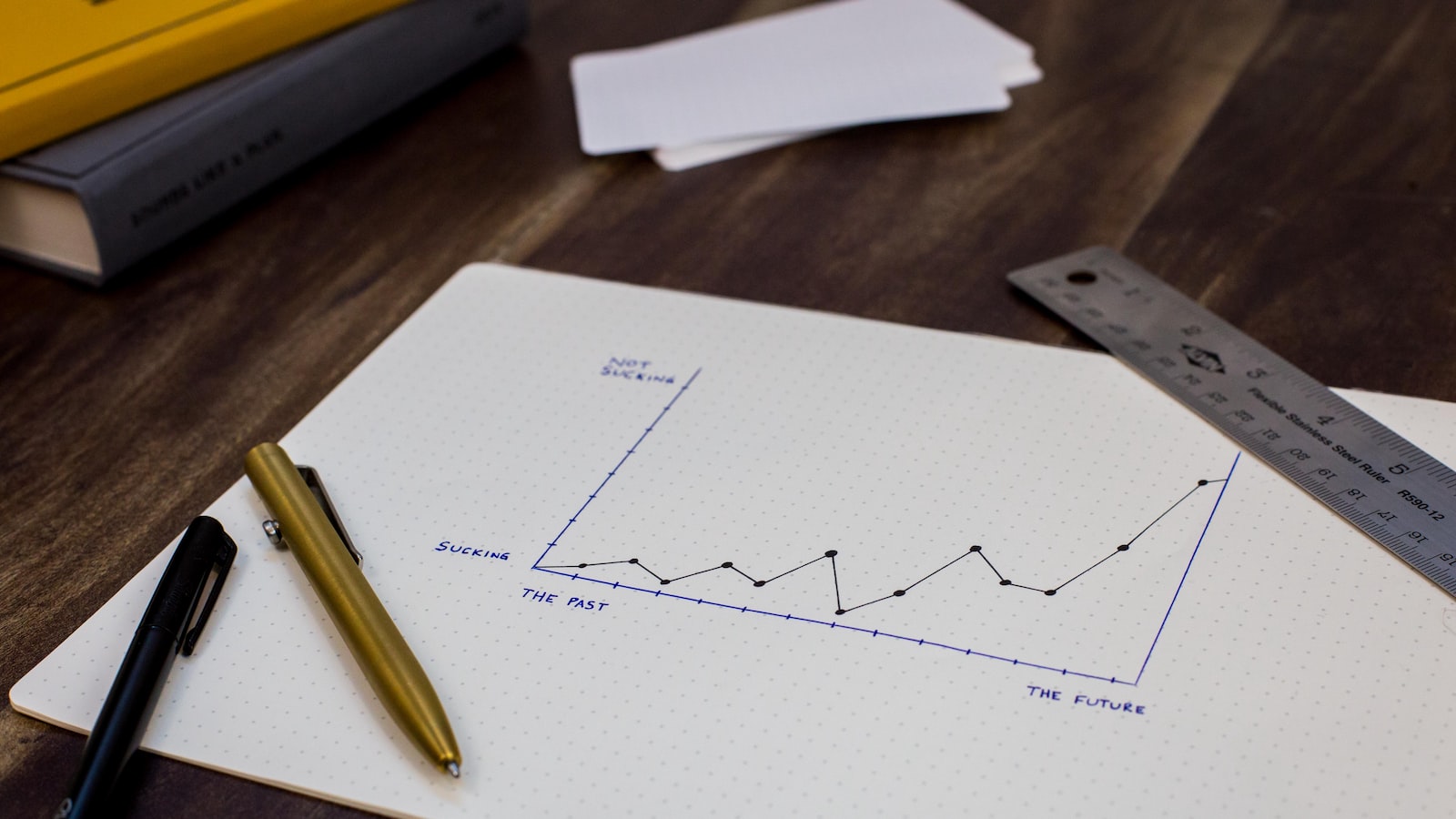

The HODL strategy emphasizes the fact that one should not panic and sell their assets in a down market, as that could lead to missing out on an eventual market recovery. This can be helpful when crypto prices are volatile or during periods of economic uncertainty, when stability is favored. Moreover, staying invested over a longer period of time could lead to higher profits, since you hold onto your coins as they appreciate in value.

Some key advantages of the HODL strategy are:

- No need to constantly monitor the market and make decisions

- Reduces your exposure to risks associated with the crypto market

- You have time to study the market and adjust your positions

Although the strategy is popular, it is not without its risks. The most significant risk is inflation, which can erode the purchasing power of your digital assets over time. Additionally, prices can move against you for prolonged periods, leading to losses if you decide to sell. It is important to do some research and be comfortable with the strategy, since it favors a buy-and-hold attitude.

2. Leveraging The HODL Strategy For Maximum Profits

The HODL strategy is a popular investment technique used by crypto traders around the world