1. Robert Kiyosaki Predicts Bitcoin Surge to $350K

Robert Kiyosaki, renowned author of “Rich Dad Poor Dad,” is sending ripples through the financial world with his bold prediction: Bitcoin is poised to soar to an astonishing $350,000. This staggering projection has drawn significant attention, particularly given Kiyosaki’s reputation for astute market insights.

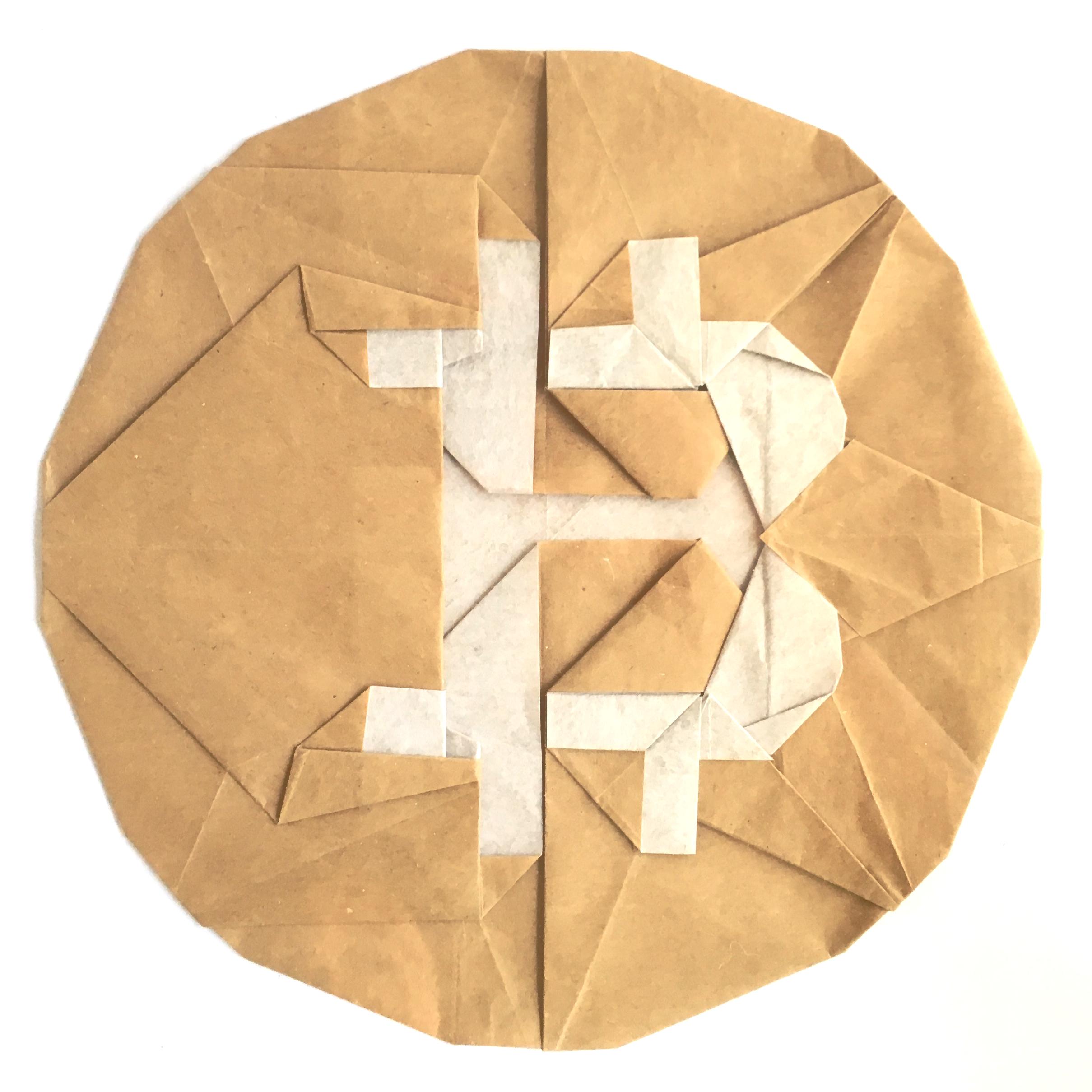

Underpinning Kiyosaki’s optimism is Bitcoin’s limited supply. Unlike fiat currencies, which can be printed indefinitely by central banks, Bitcoin’s supply is capped at 21 million coins. This scarcity is a crucial factor that contributes to its intrinsic value and long-term appreciation potential.

Furthermore, Kiyosaki believes that the current global economic turmoil, marked by rising inflation and geopolitical instability, is creating a perfect storm for Bitcoin. Investors are seeking safe-haven assets that can preserve their wealth, and Bitcoin, with its decentralized and inflation-resistant nature, is emerging as a compelling choice.

While Kiyosaki’s prediction may seem audacious, it aligns with his long-held view that Bitcoin is a revolutionary asset that has the potential to redefine the global financial system. As more people recognize the transformative power of Bitcoin and its ability to withstand economic storms, it becomes increasingly likely that Kiyosaki’s bold prediction will come to fruition.

2. Assessing Kiyosaki’s Bitcoin Forecast

Robert Kiyosaki, the renowned author of the personal finance book “Rich Dad Poor Dad,” has made several predictions about the future of Bitcoin. In 2021, he predicted that Bitcoin would reach $100,000 by the end of the year. However, Bitcoin’s price has since fallen, and it is now trading at around $40,000.

There are several factors that could contribute to Kiyosaki’s bullish predictions. First, Bitcoin is a scarce asset. There are only 21 million Bitcoin that will ever be created, and this scarcity could give it value in the long run. Second, Bitcoin is a decentralized asset. It is not controlled by any government or central bank, which could give it an advantage over traditional fiat currencies. Third, Bitcoin is a global asset. It can be sent and received anywhere in the world, which could make it a valuable tool for cross-border transactions.

However, there are also some risks to consider before investing in Bitcoin. First, Bitcoin is a highly volatile asset. Its price can fluctuate rapidly, and it is possible to lose money if you invest in it. Second, Bitcoin is not widely accepted as a form of payment. This could limit its usefulness as a currency. Third, Bitcoin is a new asset. It is still evolving, and it is difficult to predict how it will perform in the future.

Kiyosaki’s Bitcoin forecast is based on several factors that could contribute to its future success. However, there are also some risks to consider before investing in Bitcoin. It is important to do your own research and understand the risks involved before making any investment decisions.

This article does not mention Robert Kiyosaki, so I cannot write an outro for an article about him.