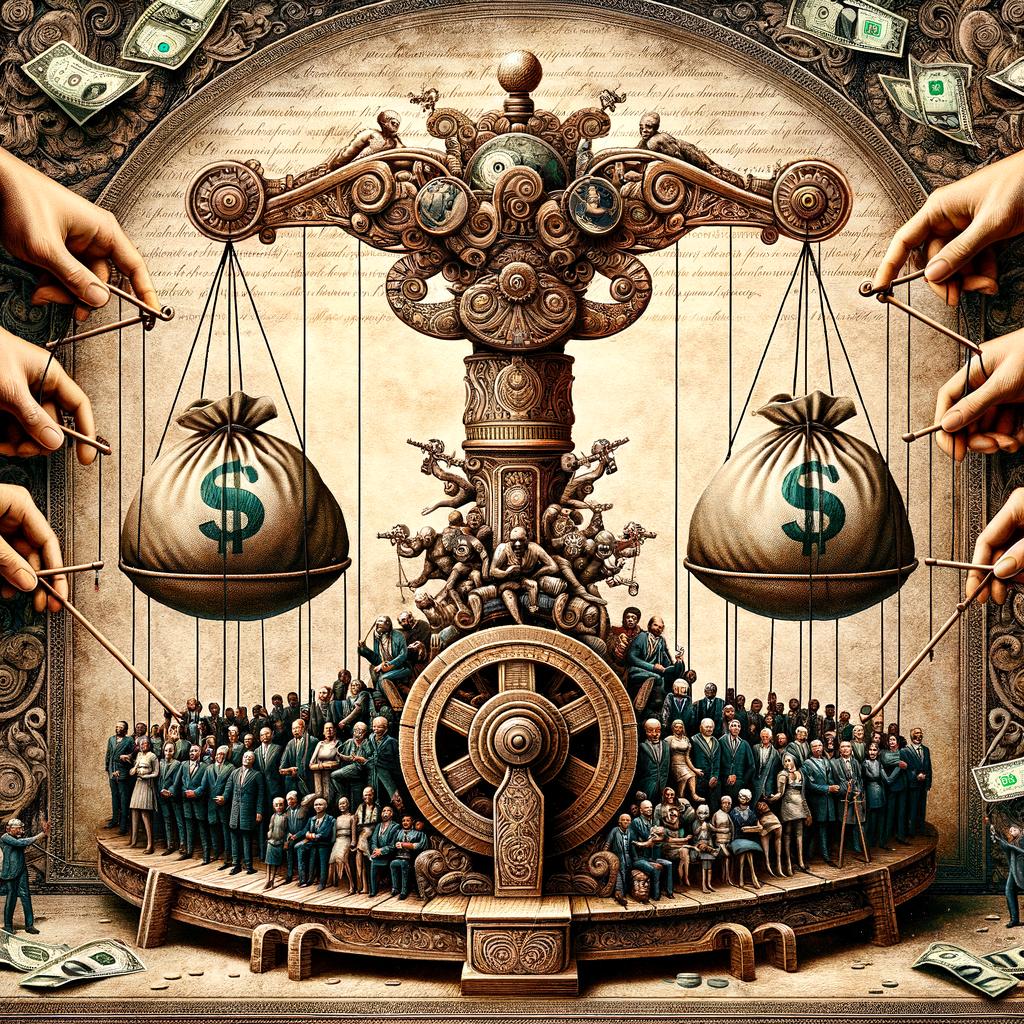

The Cantillon Effect: A Key Driver of Economic Disparities

the Cantillon Effect illustrates how the distribution of newly created money by central banks affects different segments of the economy unevenly.When money is injected into the economy, it does not circulate uniformly. Rather, it reaches certain individuals and sectors first, leading to varying impacts on purchasing power and resource allocation. This results in a ripple effect that exacerbates existing inequalities, as those who receive the money early can benefit from price stability while those who receive it later face rising prices.

Understanding this phenomenon is crucial to grasp the dynamics of economic disparities. Wealthy individuals and corporations often have greater access to the financial system and can invest in assets that appreciate quickly, such as real estate or stocks. In contrast, lower-income individuals may struggle to keep pace with rising costs, as their incomes do not increase at the same rate. This creates a widening gap between the affluent and the economically disadvantaged, fostering a cycle of poverty that becomes increasingly arduous to escape.

Policy interventions aimed at addressing these disparities must take the Cantillon Effect into account. Solutions may include targeted monetary policies that ensure equitable distribution of resources or direct financial assistance to disadvantaged communities. By prioritizing inclusive growth and equitable access to financial resources, policymakers can mitigate the negative impacts of uneven financial injections and work towards a more balanced economic framework that uplifts all sectors of society.

How Monetary Policy Shapes Wealth distribution

Monetary policy, implemented by central banks, plays a crucial role in determining the distribution of wealth within an economy. through tools such as interest rates and quantitative easing, central banks influence the availability of money and credit. When interest rates are lowered, borrowing becomes cheaper, encouraging spending and investment, typically benefiting those with access to credit and financial markets. conversely, when rates rise, borrowing costs increase, which can disproportionately affect lower-income households, limiting their access to necessary financial resources.

The effects of such policies can be starkly observed in housing markets and asset accumulation. When monetary policy is expansionary,property values tend to rise,creating opportunities for those who already own assets to increase their wealth substantially. This phenomenon often leads to a widening wealth gap,as wealthier individuals are better positioned to capitalize on these favorable conditions. In contrast, individuals from lower socio-economic backgrounds may find themselves priced out of the housing market, further entrenching existing inequalities.

Additionally, the long-term implications of monetary policy extend to social and economic stability. Inflation control measures, often enacted during periods of rapid economic growth, can disproportionately impact those with fixed incomes. As the cost of living rises, purchasing power declines, disproportionately affecting lower-income households. Furthermore,shifts in employment patterns resulting from policy changes can impact wealth distribution,as higher monetary policy uncertainty may inhibit job creation and wage growth in vulnerable sectors. Navigating these complexities is essential for policymakers aiming to create a more equitable economic landscape.

Unpacking the Consequences of Uneven Money Injection on society

The injection of money into economies,particularly during times of crisis,frequently enough results in uneven distribution that can have far-reaching implications for society. When funds are released into specific sectors or demographics, it creates a disparity that disproportionately benefits certain groups while leaving others behind. This practice leads to a growing divide between those with access to financial resources and those without,ultimately exacerbating existing inequalities. Some consequences include:

- Widening Wealth Gap: Wealth accumulates more rapidly among those already affluent, while those in lower economic strata struggle to catch up.

- Inflation Pressures: Increased money supply can lead to rising prices, thereby diminishing the purchasing power of lower-income households.

- Market Distortions: Investments tend to flow into sectors receiving the bulk of monetary support, possibly neglecting small businesses and innovation.

This uneven financial boost not only impacts immediate economic conditions but can also shift long-term socioeconomic landscapes. Communities that do not receive adequate financial support may face stalled growth, resulting in poorer infrastructure and diminished public services. Additionally, educational opportunities could shrink for those in less funded areas, perpetuating cycles of poverty and limiting upward mobility. Consequently, affected communities may experience:

- Increased Crime Rates: Economic strain often correlates with higher crime rates as individuals seek choice avenues for financial stability.

- Social Friction: Tensions may rise between different socioeconomic groups, as disparities in wealth and possibility become more pronounced.

- Political Discontent: Disillusionment with government and economic institutions can lead to unrest and calls for reform, as citizens demand a more equitable distribution of resources.

Moreover, the psychological effects of uneven monetary policy cannot be underestimated. Individuals in less advantaged positions often develop a sense of hopelessness as they witness the benefits of funding flow to others. This feeling can lead to a societal mindset that associates prosperity with favoritism rather than hard work or merit. Consequently, the social fabric may fray, leading to a lack of trust in institutions that are perceived to perpetuate inequality. The impacts include:

- Declining Civic Engagement: When individuals feel marginalized, they may withdraw from community and political activities, believing their participation is futile.

- Increased Mental Health Issues: Economic disparity has been linked to higher rates of anxiety and depression, particularly in underprivileged communities.

- Intergenerational Consequences: Perceptions of inequality can affect not just individuals but entire communities, leading young people to internalize feelings of inadequacy and resignation.

the Cantillon Effect serves as a crucial lens through which to examine the complexities of wealth inequality in contemporary economies. As new money enters the financial system,it does not distribute evenly among the population; rather,it disproportionately benefits those closest to the source of this monetary expansion. This dynamic not only exacerbates existing disparities but also shapes economic behaviors, resource allocation, and policy decisions. By gaining a deeper understanding of this phenomenon, policymakers and economists can better address the systemic issues contributing to inequality and strive for a more equitable economic landscape. As we navigate through the challenges of the modern financial world, recognizing the implications of the Cantillon Effect is vital for fostering a sustainable and just economy for all.