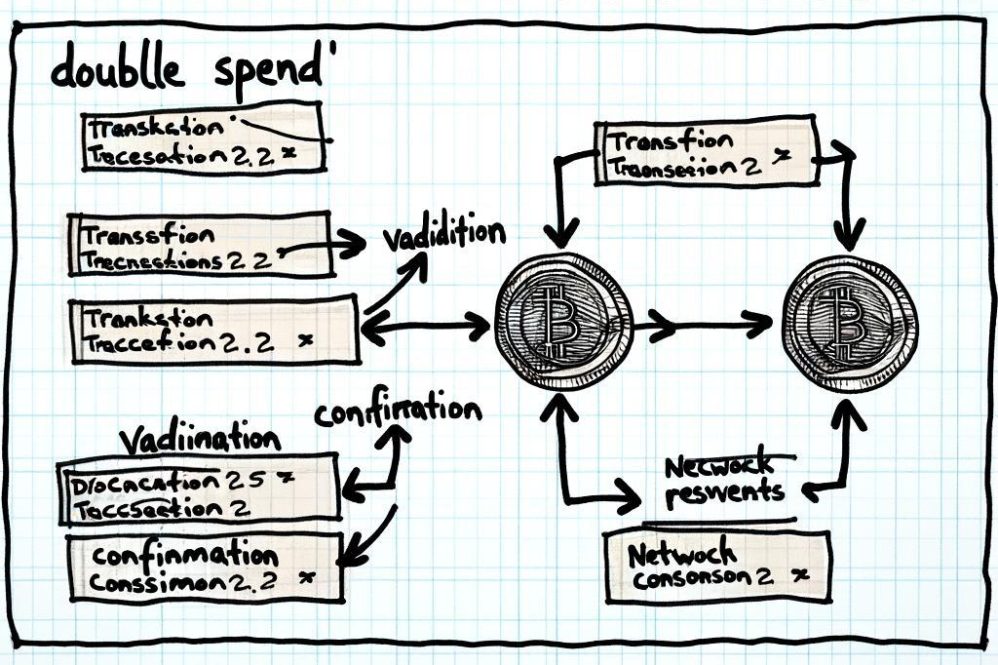

Double Spend Explained: What it is indeed and Why It Matters

At its core, a double spend is an attempt to use the same digital coin more than once – a unique challenge for digital cash that blockchain design seeks to eliminate. In Bitcoin’s UTXO model this problem is resolved through distributed consensus: nodes accept only one history of transactions (the longest valid proof-of-work chain), and confirmed blocks make earlier transactions progressively harder to reverse. Practically speaking,a accomplished double-spend requires creating a competing chain that outpaces the honest network,which in theory needs control of more than 50% of the hashing power (a 51% attack). For everyday users and merchants,the industry rule-of-thumb remains to wait for 6 confirmations (roughly one hour on Bitcoin) for high-value payments,while recognizing that low-value or zero-confirmation transactions carry materially higher risk.

Consequently, the market context and the architecture of a given chain strongly influence double-spend risk. Smaller proof-of-work networks with low hash rates have repeatedly been targeted in past incidents, producing multi-million-dollar losses for exchanges and merchants; by contrast, large networks benefit from broad miner distribution and higher attack costs. Volatility and liquidity also matter: during rapid price swings, liquidity-driven arbitrage can increase the appeal of attacks and complicate exchange settlement. To reduce exposure, stakeholders commonly adopt practical mitigations, including:

- For merchants/newcomers: require multiple confirmations for on-chain settlement, prefer trusted custodial or exchange rails for instant settlement, and display clear transaction-value thresholds for instant acceptance.

- For exchanges/traders: implement real-time reorg detection, use full-node validation, and maintain cold-wallet segregation with multi-signature custody for large holdings.

- For developers: design applications to reject or flag zero-confirmation reliance, and consider fallback settlement paths when reorgs are detected.

These steps balance customer experience against security in line with operational risk tolerance.

the ecosystem continues to evolve with layered technical and policy responses that lower double-spend exposure while expanding utility. At the protocol level, mechanisms such as dynamic block-confirmation heuristics, fee-bumping tools like Replace-By-Fee (RBF) and Child-Pays-For-Parent (CPFP), and higher network hash rate improve finality. Layer‑2 solutions such as the Lightning Network offer near-instant payments with different trust assumptions – users should therefore understand watchtowers and channel backup strategies to manage risk. Simultaneously occurring, regulatory trends toward stronger custody rules and KYC can reduce certain types of fraud but do not eliminate technical attack vectors, so both newcomers and experienced participants should combine on-chain best practices with institutional controls: run your own node, tailor confirmation policies to transaction value, and monitor chain health (orphan/reorg rates and mining distribution) to keep risk within acceptable bounds.

Inside a Double-spend Attack: Methods, motives and Real-World Examples

Cryptographically, most double-spend attacks exploit the gap between transaction broadcast and final settlement. Common methods include the race attack (competing transactions broadcast to different nodes), the Finney attack (a miner includes a conflicting transaction in a secretly mined block), and the canonical 51% attack where an adversary controls a majority of mining power and creates a longer alternate chain to overwrite confirmed transactions. In addition, replay attacks can occur after hard forks if transactions remain valid on both chains.Because bitcoin’s average block time is ~10 minutes,practitioners often cite 6 confirmations (~1 hour) as a practical finality benchmark for large-value BTC transfers; however,smaller or newer proof-of-work chains with lower aggregate hashpower are susceptible to deep reorganizations when attackers rent hashpower on markets such as hashpower marketplaces,enabling double-spends at materially lower cost than attempting to attack Bitcoin itself.

Motives for executing a double-spend range from straightforward financial gain to network disruption and protest.Such as, malicious actors have targeted less-secure pow networks in recent years by renting hashpower to produce short-lived reorganizations and realize fiat gains from exchanged coins, prompting exchanges to suspend withdrawals and delist vulnerable tokens. Moreover, organized fraud rings may use double-spends against merchants to obtain goods and liquidity, or to create uncertainty that depresses market confidence. as an inevitable result, market participants and regulators have increasingly emphasized resilience: exchanges now monitor for reorg depth, set dynamic confirmation thresholds, and sometimes require on-chain proof-of-reserve after high-risk incidents. Importantly, while Bitcoin’s sheer hashpower concentration makes successful, sustained double-spends on BTC prohibitively expensive in practice, smaller-cap coins routinely show measurable risk-illustrating how network security scales with adoption and miner economics.

For both newcomers and seasoned operators, practical mitigations are straightforward and actionable: merchants should implement risk-based confirmation policies, and custodial platforms must enforce finality thresholds and real-time chain-monitoring. Recommended steps include:

- For retail payouts under ~$100,consider controlled zero-confirmation acceptance with double-spend detection tools;

- For mid-size transfers,require 3 confirmations (~30 minutes); for large transfers,require 6+ confirmations or on-chain analytics that detect anomalies;

- For exchanges and custodians,deploy automated reorg detection,require multi-block depth for withdrawals,and use diversified checkpointing or multi-client validation to reduce single-point SPV risks.

Furthermore, experienced operators should monitor mempool behaviour, fee-bumping flags like RBF, and hash-rate fluctuations that could presage rented-hashpower attacks. Taken together, these measures-paired with broader ecosystem steps such as better on-chain transparency, regulatory clarity for custody practices, and migration to consensus models appropriate for a chain’s security needs-help manage the tangible risks of double-spending while preserving the efficiency and openness that make cryptocurrencies valuable.

countermeasures and Best Practices: How Blockchains and Users Prevent Double Spending

At the protocol level,the primary defense against double spending is decentralized consensus-most notably Bitcoin’s proof-of-work and the longest-chain rule. Each block confirmation increases the economic cost for an attacker to rewrite history: with Bitcoin’s ~10‑minute block times, the conventional industry benchmark of 6 confirmations (≈1 hour) is used for high‑value transfers because the probability of a successful chain reorganization falls steeply as confirmations accumulate. In contrast, smaller proof‑of‑work chains have seen costly 51% attacks and deep reorgs in recent years, which underscores how security is a function of distributed hashrate and economic incentives. consequently, exchanges, custodians and institutional counterparties factor confirmation policies, network fees and miner concentration into custody and settlement rules to manage systemic risk.

For practitioners and merchants, operational controls reduce exposure to double‑spend attempts while preserving user experience. Best practices include both simple policies and technical safeguards:

- Tiered confirmation policies: accept 0-1 confirmations for micro‑payments (with limits), 2-3 for everyday retail, and 6+ for high‑value transfers or when compliance requires finality;

- Transaction hygiene: disable or refuse RBF (replace‑by‑fee) payments when final settlement is required, monitor the mempool for conflicting transactions, and use block explorers and backend watchers to detect double‑spend attempts;

- Alternative rails and cryptographic guarantees: adopt payment channels such as the lightning Network for instant finality on small payments, use multisig or escrow for large OTC trades, and deploy watchtowers/HTLCs to protect off‑chain settlements.

These steps give newcomers clear, actionable thresholds while offering experienced operators a layered defense-in-depth approach.

Looking ahead, broader market forces and regulatory trends shape the effectiveness of technical countermeasures. Greater institutional adoption and network growth-along with Bitcoin’s hashrate remaining in the hundreds of exahashes per second as of 2024-make 51% attacks on Bitcoin prohibitively expensive, while AML/KYC requirements and chain‑analytics tools reduce the incentives for on‑chain fraud by narrowing avenues to cash out stolen funds. Nevertheless, trade‑offs persist: higher on‑chain fees and congestion can increase reliance on zero‑confirmation flows (raising risk), whereas scaling solutions and increased Lightning adoption lower that exposure for everyday commerce. a pragmatic strategy combines protocol security, disciplined confirmation policies, cryptographic primitives (multisig/HTLC), and robust monitoring-an approach that balances opportunity and risk in the evolving crypto ecosystem.

As cryptocurrencies move from niche technology to mainstream payment rails, understanding double spend isn’t just academic – it’s practical. At its core, double spend is a threat born of digital money’s copyable nature; blockchain’s cryptography, distributed consensus and transaction confirmations are the defenses that make digital cash trustworthy in practice. Whether an attempt comes as a simple race attack, a more sophisticated Finney trick, or the extreme 51% takeover, the mechanics are the same: attackers try to present conflicting transaction histories and exploit delays in confirmation.

For everyday users and businesses that accept crypto, the takeaway is straightforward: rely on confirmed transactions, understand the confirmation policies of the networks you use, and favor custody and exchange solutions with established security practices. For developers and policy makers, the challenge is to keep improving protocol resilience, monitoring systems for concentration of mining or staking power, and designing user experiences that communicate risk without creating friction.

Double spend is not an unsolvable mystery but a solvable engineering and governance problem. As the ecosystem matures, a combination of stronger decentralization, clearer standards, and better user education will keep the promise of secure digital money intact. Stay informed, verify confirmations, and treat unconfirmed transactions with caution – that’s the simplest defense against a problem that, by design, the blockchain was created to fix.