Bitcoin on the Technology Adoption S-Curve: Entering the Early Majority Era

Why Bitcoin’s current phase may represent the final window for outsized asymmetric returns.

Bitcoin Is No Longer an Experiment

Bitcoin is often discussed in terms of price cycles, halving events, and speculative mania. But those frameworks miss the bigger picture.

Bitcoin is not just an asset — it is a technology, and like all transformative technologies, it follows a Technology Adoption S-Curve.

When viewed through this lens, Bitcoin appears to be transitioning out of its early, speculative phase and into something far more consequential: early-majority adoption driven by institutions, regulated financial products, and sovereign-level legitimacy.

This shift has profound implications — not just for price, but for volatility, risk, and Bitcoin’s long-term role in the global financial system.

The Technology Adoption S-Curve Explained

The S-Curve describes how new technologies spread:

- Innovators – Experimenters and pioneers

- Early Adopters – Visionaries willing to accept risk

- Early Majority – Pragmatic participants seeking proven utility

- Late Majority – Skeptics who adopt only after standardization

- Laggards – Final holdouts

Early phases are volatile, narrative-driven, and speculative.

Later phases are slower, more stable, and utility-driven.

Bitcoin has already passed through its innovator and early-adopter eras.

Bitcoin’s Historical Position on the Curve

- 2009–2013: Cypherpunks, cryptographers, hobbyists

- 2014–2017: Early adopters, exchanges, miners, first speculation

- 2018–2020: Infrastructure build-out, custody, derivatives

- 2021–2023: Institutional awareness, regulatory engagement

- 2024–Present: Institutional entry at scale

Each phase reduced existential risk while expanding the addressable market.

The Key Question: Where Is Bitcoin Today?

Verdict: Early Majority — Approaching the Inflection Point

Bitcoin is best positioned at the beginning of the Early Majority phase, near the inflection point of the S-curve.

This placement is justified by three converging forces:

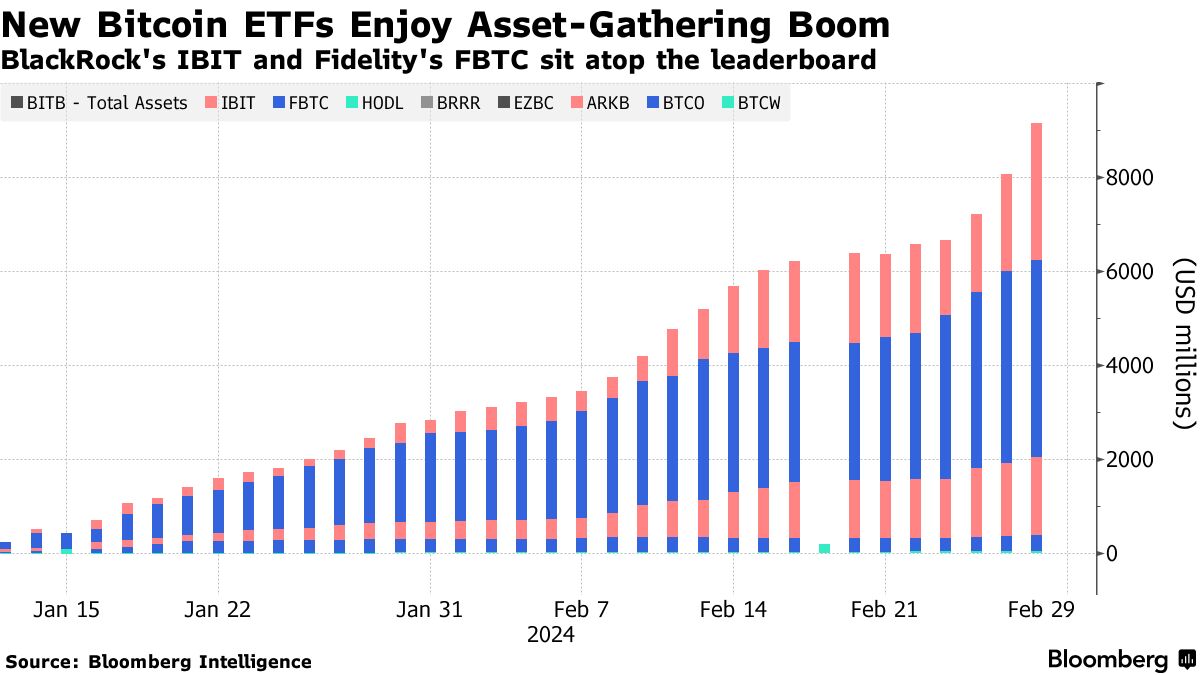

1. Institutional Capital Has Arrived

Bitcoin ETFs Changed the Game

Bitcoin ETFs represent a structural shift:

- Regulated access through traditional brokerage accounts

- Automatic custody and compliance

- Persistent demand due to fund mechanics

Historically, ETFs have transformed markets by:

- Lowering friction

- Increasing liquidity

- Attracting conservative capital

Bitcoin ETFs function as a permanent bid for a finite asset.

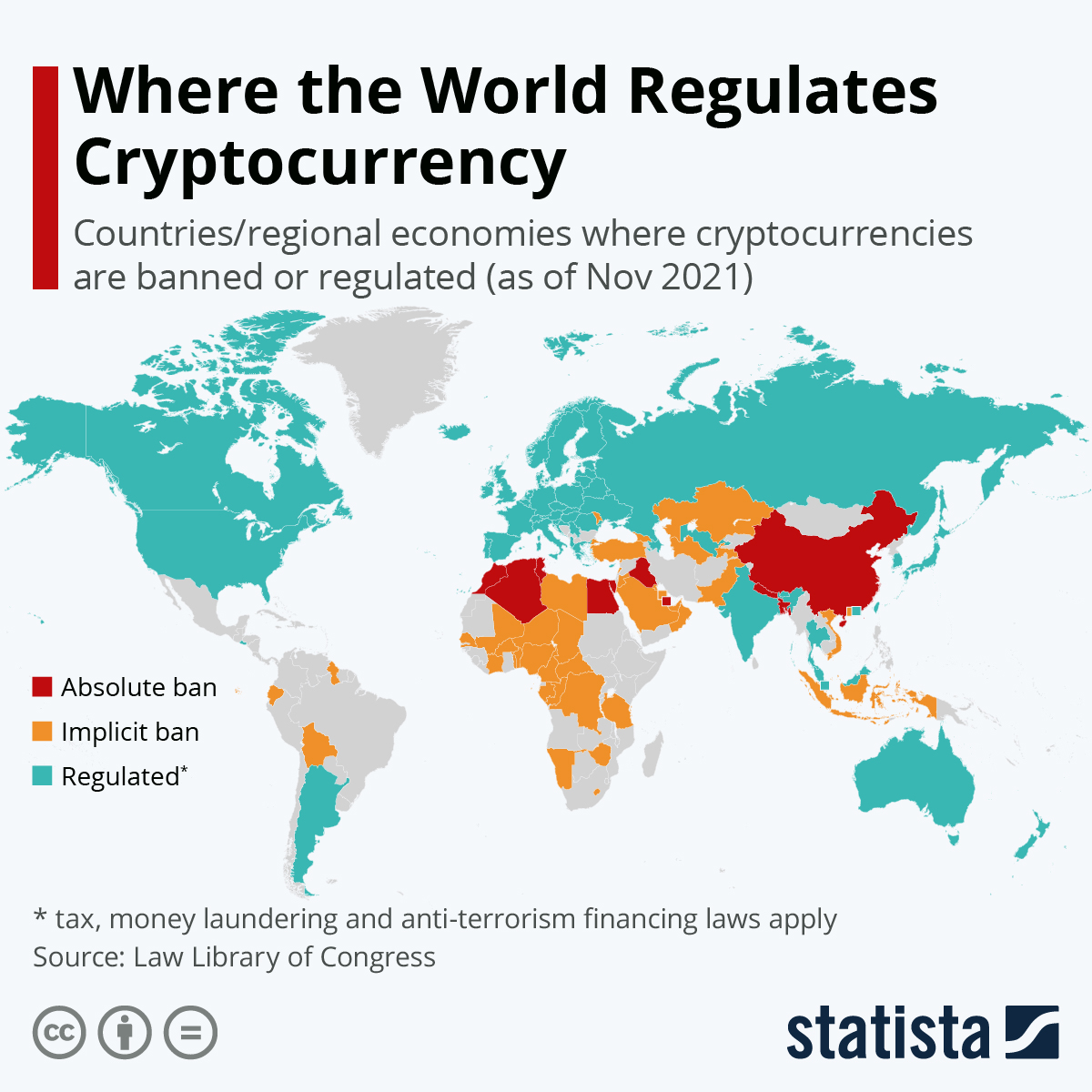

2. Regulatory Clarity Removed the Final Barrier

Institutions do not operate in ambiguity.

They require legal clarity, custody standards, and risk frameworks.

Recent years have delivered:

- Clearer regulatory classifications

- Institutional custody solutions

- Accounting and compliance standards

This marks the transition from “Can we own Bitcoin?”

to “How much exposure is appropriate?”

That question defines early-majority adoption.

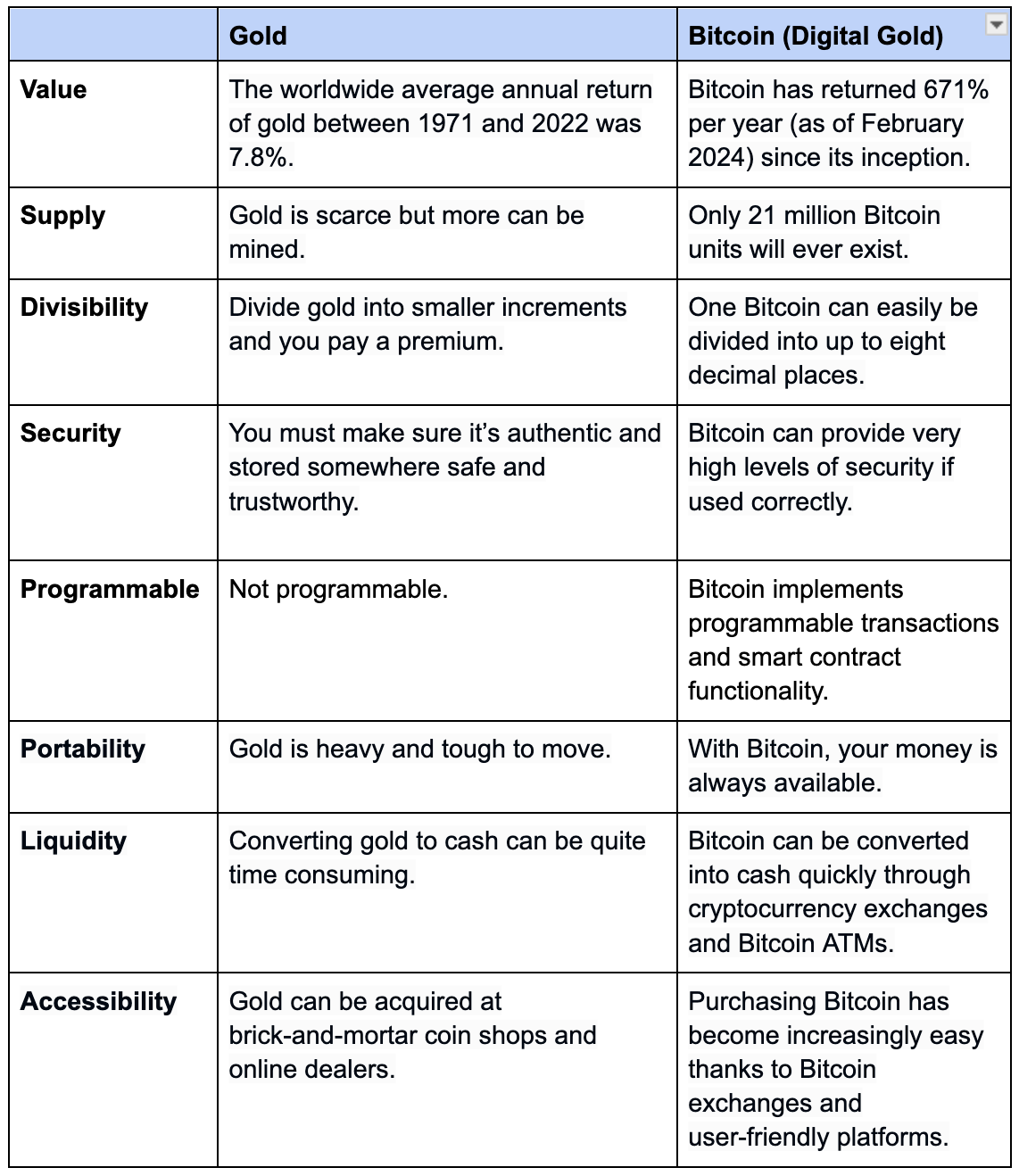

3. Bitcoin’s Narrative Has Matured

Bitcoin is no longer sold primarily as:

- A payment rail

- A speculative trade

- A niche technology

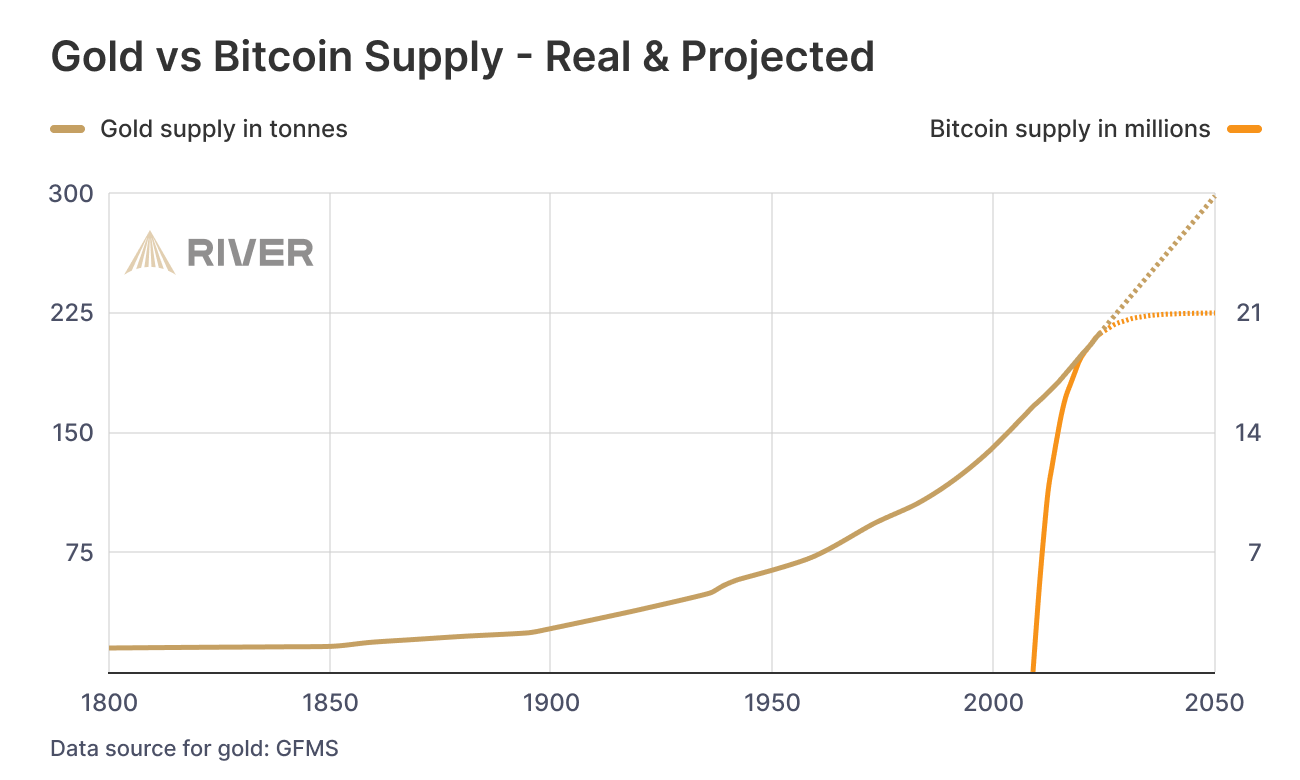

Instead, it is increasingly understood as:

- A scarce monetary asset

- A non-sovereign reserve

- A digital analogue to gold

This narrative shift aligns with how early-majority adopters think:

utility first, ideology second.

The Inflection Point: Why It Matters

On an S-Curve, the inflection point is where:

- Adoption accelerates fastest

- Risk perception collapses

- Capital inflows scale non-linearly

Bitcoin appears to be here.

But this is also where returns begin to change character.

The “Downhill” Phase Does NOT Mean a Crash

A common misunderstanding:

“Once Bitcoin hits the late majority, the upside is over.”

That’s incorrect.

What Actually Changes

1. Volatility Declines

Speculative assets are volatile.

Monetary assets stabilize as:

- Ownership broadens

- Liquidity deepens

- Time horizons extend

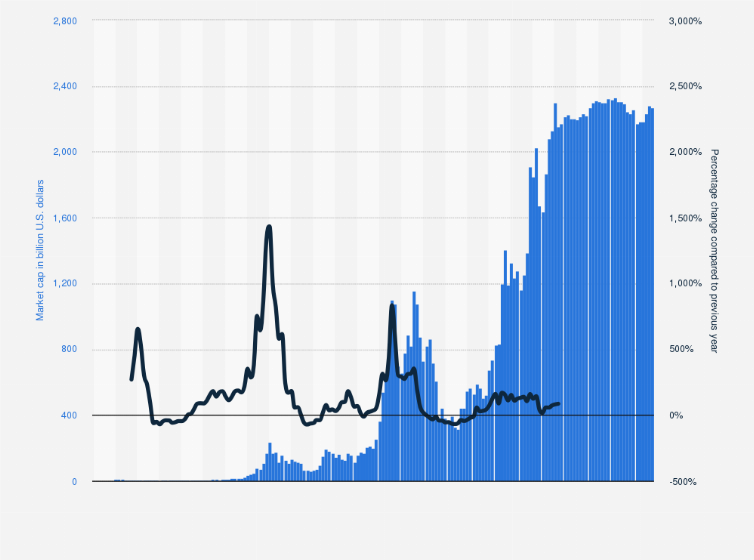

Bitcoin’s volatility has already been structurally declining over cycles.

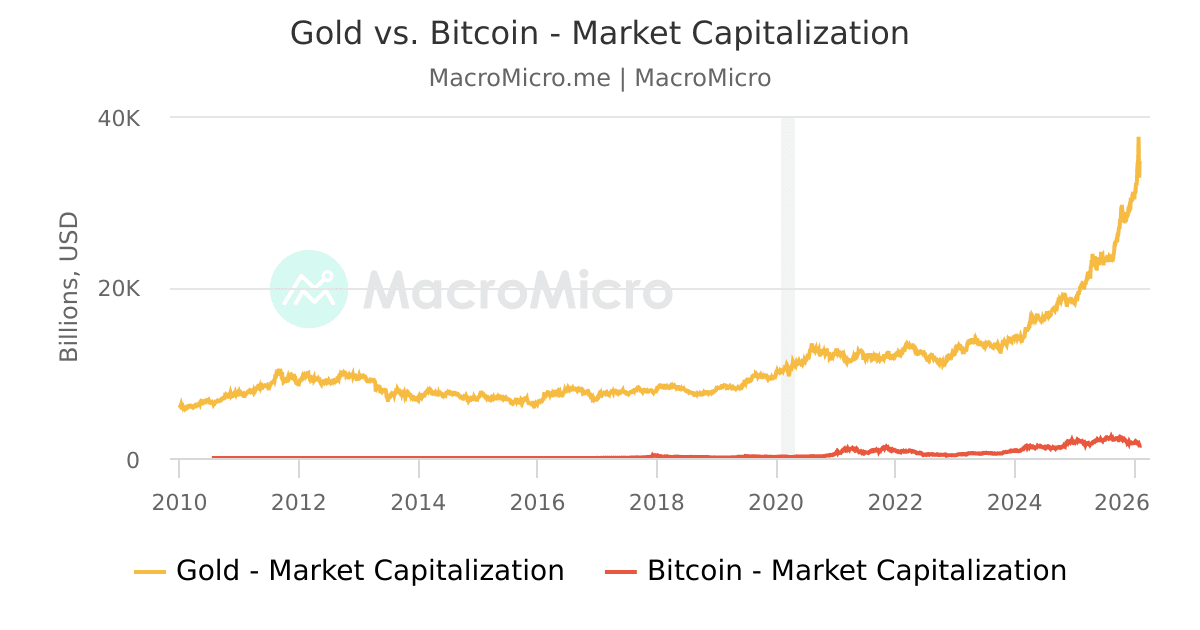

2. The Price Floor Rises

With:

- ETFs

- Corporate treasuries

- Sovereign exposure

- Long-term custodians

Selling pressure diminishes while demand becomes structural.

Scarcity + structural demand = higher equilibrium prices.

3. Returns Normalize (But Don’t Disappear)

Bitcoin’s future may resemble gold more than a startup:

| Asset | Volatility | Role |

|---|---|---|

| Early Bitcoin | Extreme | Speculative |

| Current Bitcoin | High | Transitional |

| Mature Bitcoin | Moderate | Monetary |

Gold still appreciated meaningfully — just without 10× annual moves.

Why This Phase May Be the Last for Outsized Gains

Historically:

- Innovators get ideology

- Early adopters get asymmetric returns

- Early majority gets strong but stabilizing returns

- Late majority gets preservation, not explosiveness

If Bitcoin is truly entering the early majority, then:

The biggest multiple expansion may already be underway — not ahead.

New Use Cases Extend the Curve

Importantly, Bitcoin’s S-Curve may elongate, not flatten, due to:

- Layer-2 payment networks

- Institutional collateralization

- Sovereign reserves

- AI agents using Bitcoin as a neutral savings asset

- Machine-to-machine economic systems

These factors may prevent stagnation even in later phases.

Final Thought: From Speculation to Infrastructure

Bitcoin is transitioning:

From “Should this exist?”

To “How is this integrated?”

That transition defines the early-majority phase on the Technology Adoption S-Curve.

For investors, this moment may represent:

- Reduced existential risk

- Increasing legitimacy

- Slower but more durable growth

Bitcoin is not peaking.

It is maturing.

And maturation is how technologies become permanent.

References & Further Reading

- Fidelity Digital Assets — The Maturation of Digital Assets

- State Street Global Advisors — Institutional Demand for Bitcoin

- Reuters — Global Bitcoin ETF Inflows & Market Impact

- Datos Insights — Bitcoin ETFs and the Institutional Adoption Curve

- TRM Labs — Global Crypto Regulatory Outlook