Note: the supplied web search results returned unrelated Google support pages, so the introduction below is based on chart-pattern analysis and market conventions rather than external sources.

Headline-ready introduction (analytical, journalistic):

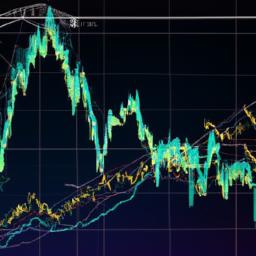

AI/USDT has delivered a striking technical progress this week: a decisive breakout from a long-developing falling wedge that, on pattern-measure basis, points to upside targets in the order of +130%. Traders monitoring the pair observed price compressing into lower highs and higher lows for several sessions before a breakout above the wedge’s upper trendline, accompanied by a noticeable pickup in volume – the classic confirmation signals technicians look for when translating structural patterns into price objectives.

At it’s core, the falling wedge is a reversal pattern that frequently precedes strong rallies when breached to the upside. Applying the measured-move technique – projecting the maximum vertical height of the wedge from the breakout point – yields the aggressive +130% target now being touted by market participants. That projection frames the potential reward,but it does not guarantee timing: the pace to the target can vary with liquidity,macro drivers and sector rotation.

Caveats temper the outlook. False breakouts, spotty volume follow-through, and broader crypto market volatility can all undercut pattern-driven scenarios; prudent traders thus seek confirmation from sustained volume, retests of the breakout line, and alignment with higher-timeframe trend indicators. for readers tracking AI/USDT, the current setup represents a compelling technical opportunity worth watching closely – but one that calls for disciplined risk management and independent verification before capital allocation.

Falling wedge breakout validates bullish thesis for AI USDT with technical targets near one hundred thirty percent upside

Technical charts show a decisive move out of a multi‑week falling wedge, with price clearing the upper trendline on above‑average volume – a classic technical confirmation that shifts the bias from consolidation to accumulation. Key signals supporting the case include:

- Volume spike accompanying the breakout, indicating institutional participation;

- Momentum indicators carving higher highs while price breaks resistance;

- Price sustaining above short‑term moving averages after the breakout.

| Projection | Level (relative) | Approx. Move |

|---|---|---|

| Measured‑move target | ~+130% | Long‑term objective |

| Near‑term resistance | ~+40-60% | First supply zone |

| Invalidation band | Close below breakout line | Technical stop |

The price projection is derived from the wedge’s maximum vertical height projected from the breakout point – a standard measured‑move technique that yields a near‑term objective consistent with roughly +130% potential upside under unchanged market structure. Timeframe expectations remain measured in weeks to months, given the pattern’s amplitude and the need for sustained follow‑through; watch for a retest of the breakout trendline as a healthy consolidation phase rather than immediate failure. Risk considerations include:

- Failure to hold above the breakout trendline – this would invalidate the bullish thesis;

- Bearish divergence on higher‑timeframe momentum indicators;

- Macro liquidity shocks that can compress risk assets quickly.

Preserving discipline around defined invalidation levels and monitoring volume/momentum on any pullback will determine whether the wedge breakout can realistically target the projected upside.

Key indicators and macro catalysts to watch and how to time entries on breakout retests

Watch for a confluence of technical and macro signals before committing: high-conviction entries require volume confirming the breakout (daily volume above the 20-day average), a positive divergence in MACD/histogram on the daily, and an RSI that avoids overbought extremes while trending upward. On the macro side, monitor broad risk appetite – namely Bitcoin strength, equity futures direction, and major economic prints (inflation surprises or fed commentary) that can flip flows into or out of altcoin-capitalized AI plays. Pay particular attention to sector-specific catalysts such as product launches, strategic partnerships, or exchange listings; these frequently enough accelerate post-wedge moves and turn tactical breakouts into sustained trends. Key short-form cues to watch include VWAP alignment on intraday pullbacks and a tightening of ATR (implying low-volatility compression ahead of an impulse leg).

Time entries by waiting for a disciplined retest setup: prefer buys on a clean rejection above the former wedge resistance turned support with increasing volume on the bounce and a clear lower-timeframe bullish pattern (higher low + wick rejection).Use a layered approach – initial position at the first retest, add on confirmed hold and momentum break on higher timeframe – and size stops below the retest low or the wedge swing low to limit tail risk. Checklist for execution:

- Confirm daily close above wedge resistance

- Validate volume and MACD momentum

- Enter on retest with stop below structure

- Scale into strength, trim into headlines

| Signal | Action |

|---|---|

| Volume surge | Prioritize entries |

| Macro risk-on | Increase conviction |

| False retest | Cut loss, re-evaluate |

Risk management and position sizing framework to capitalize on the projected rally while protecting gains

Position sizing must be systematic to exploit the projected breakout while preserving capital. Allocate no more than 5-8% of portfolio equity to AI/USDT at peak exposure and risk a maximum of 1-2% per trade. Use an ATR-based stop to reflect current volatility: place the initial stop at 1.5-2.5× ATR below the breakout candle or below the wedge’s support, whichever is wider. Enter in tranches-an initial 40-60% on the confirmed breakout, add a second tranche on a clean pullback to support, and reserve a final allotment for momentum continuation.This approach balances early capture of the move with disciplined capital conservation. Practical rules to implement:

- Risk size: calculate position so the stop-loss equals 1-2% of total equity.

- Entry: first tranche at breakout close,add on retest.

- Max exposure: cap AI/USDT to 5-8% of portfolio to limit concentration.

Protecting profits requires staged profit-taking and adaptive trailing stops tied to volatility and price action. Lock partial gains at predefined milestones-suggested partials: 30% at +25-35%, 40% at +60-80%, and the remainder on approach to the target zone near +130%, or convert to a tight trailing stop when momentum is strong. Use a volatility-adjusted trailing stop (e.g., 1× ATR beneath price swings) to avoid being whipsawed while preserving upside. Situational rules:

- Profit lock: move stop to breakeven after the first tranche reaches +25-30%.

- Scale out: reduce size progressively to crystallize gains and lower theta of risk.

- Re-assess: if on-chain or macro signals turn bearish, reduce exposure regardless of trailing stop.

Key Takeaways

In sum,the technical picture for AI/USDT following the falling‑wedge breakout is constructive but conditional. the pattern projects an aggressive upside objective – roughly +130% from the breakout point – yet the path to that target will depend on clear confirmation, market context and disciplined risk management. Traders should look for a decisive close above the wedge resistance on elevated volume,a clean retest of the breakout as support,and follow‑through buying to validate continuation toward the measured move.

Risk remains material. False breakouts, broader market selloffs, or shifts in liquidity and macro sentiment can invalidate the bullish thesis; a pragmatic stop-loss beneath the wedge low or a nearby structural support level limits downside while preserving upside exposure. timeframe is likely medium-term (weeks to months) rather than immediate; patience for confirmation and staged position sizing can improve risk-reward.

For further clarity, monitor volume, open interest (for derivatives), intermarket correlations and any basic news affecting AI token utility or regulatory treatment.Keep alerts on key levels and be prepared to adjust targets if price action diverges from the ideal scenario.

As always, this analysis is not investment advice but a technical assessment to inform decision‑making. We will continue to track AI/USDT and report on material developments that alter the risk profile or price trajectory.