Stablecoin Reserves Explained: USDT, USDC, DAI and the Truth About “Proof”

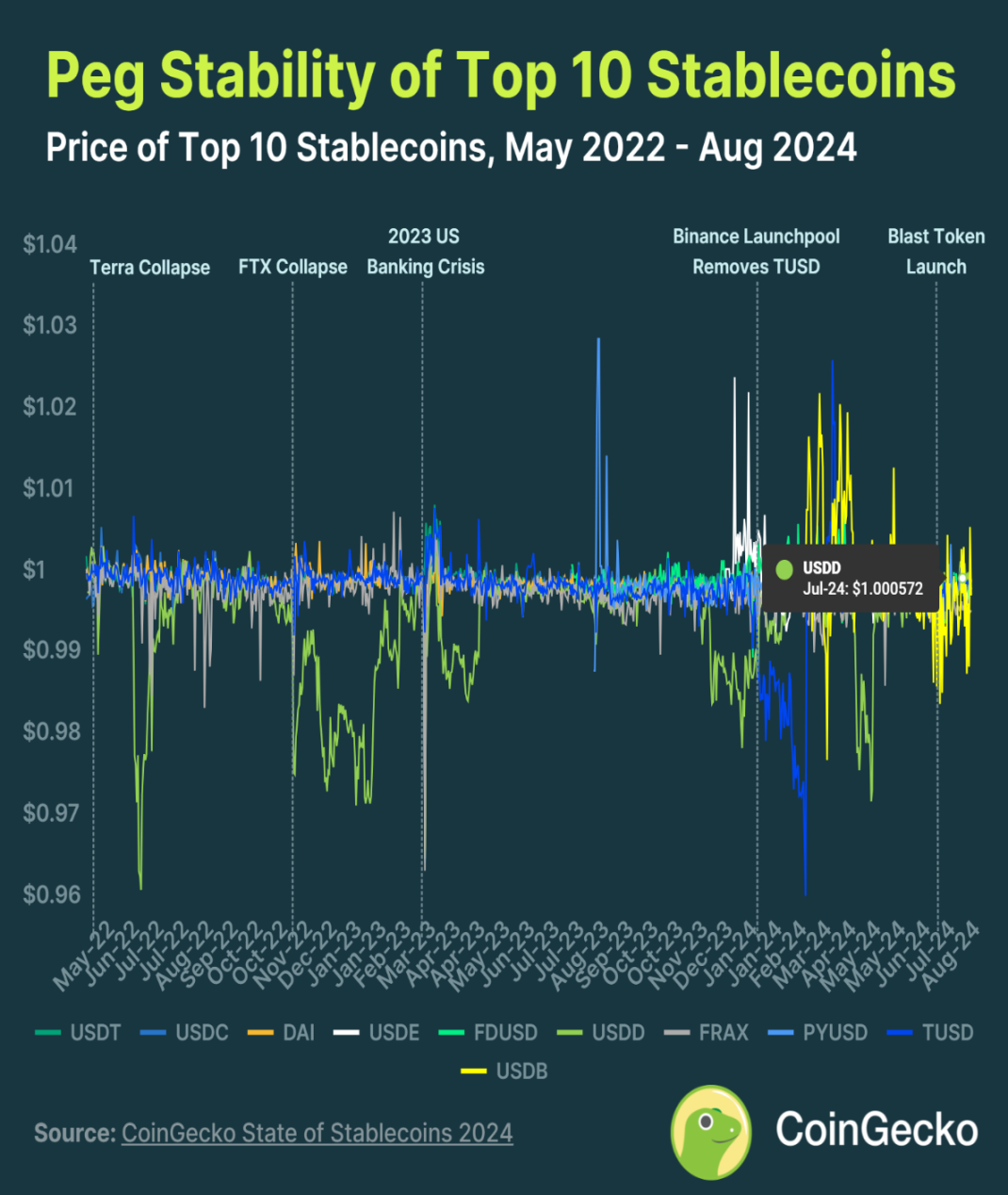

Stablecoins promise the best of both worlds: crypto rails with dollar stability.

But that promise rests on a single question:

What’s actually backing the tokens?

This guide examines how the biggest dollar stablecoins structure reserves and what “proof of reserves” really means in practice.

We’ll look at:

- Tether (USDT)

- Circle (USDC)

- MakerDAO (DAI)

- And the mechanics of reserve attestations vs true audits

What “1:1 Backed” Is Supposed to Mean

A fully reserved dollar stablecoin should hold $1 of high-quality liquid assets for every $1 token issued.

In practice, reserves may include:

- Cash in banks

- Short-term U.S. Treasury bills

- Money market funds

- Secured loans

- Other crypto assets (for decentralized models)

The mix matters. Liquidity matters. Transparency matters.

USDT — The Largest, Most Debated

4

Issuer: Tether

Model: Centrally issued, fiat-backed

Primary reserves: U.S. Treasuries, cash equivalents, secured loans, other assets

Tether publishes quarterly attestations summarizing reserve composition. Over time, the company has shifted heavily toward short-term U.S. Treasuries, increasing perceived safety and liquidity.

Key point: These are attestations, not full audits. They confirm balances at a point in time based on documents provided.

Risk lens

- Counterparty and banking exposure

- Opaque corporate structure

- Reliance on attestations rather than audits

Yet, USDT remains the most liquid stablecoin globally, especially on exchanges outside the U.S.

USDC — The Compliance-First Stablecoin

4

Issuer: Circle

Model: Centrally issued, fiat-backed

Primary reserves: Cash and short-term U.S. Treasuries held with regulated custodians

Circle provides monthly attestations and emphasizes relationships with regulated U.S. financial institutions.

Strengths

- High transparency cadence

- Conservative reserve mix

- Clear redemption pathways

Trade-off

- Heavily exposed to the U.S. banking system (as seen during regional bank stress events)

- Censorship capability at the smart contract level

DAI — Crypto-Collateral with a Fiat Spine

4

Issuer: MakerDAO

Model: Overcollateralized crypto + real-world assets

Reserves: ETH, USDC, tokenized Treasuries, other collateral

DAI is minted when users lock collateral into smart contracts. Historically crypto-backed, DAI now relies significantly on USDC and tokenized Treasury exposure to maintain peg stability.

Key insight: DAI is decentralized in governance, but partially centralized in collateral.

Risk lens

- Smart contract risk

- Dependence on USDC for stability

- Market volatility of crypto collateral

Attestation vs Audit — Why the Words Matter

| Term | What It Means | What It Doesn’t Mean |

|---|---|---|

| Attestation | Accountant verifies documents at a date | No continuous oversight |

| Audit | Deep review of systems, controls, liabilities | Rare among stablecoin issuers |

| Proof of reserves | Snapshot of assets | Often omits full liabilities picture |

A reserve report can show assets exist that day without proving they’re unencumbered, liquid under stress, or matched perfectly to liabilities at all times.

Comparative Reserve Philosophy

| Stablecoin | Reserve Style | Transparency | Main Risk Vector |

|—|—|—|

| USDT | Broad basket, Treasury-heavy | Quarterly attestation | Corporate opacity |

| USDC | Cash + Treasuries | Monthly attestation | Banking system exposure |

| DAI | Overcollateralized crypto + RWAs | On-chain visibility | Collateral dependence on USDC |

What “Proof” Should Ideally Look Like

A gold standard would include:

- Real-time asset reporting

- Full liability disclosure

- Independent, recurring audits

- Clear legal claim for token holders

- Stress-test liquidity scenarios

No major stablecoin fully meets all five today.

Why This Matters for Bitcoin Users

Many Bitcoiners touch stablecoins for:

- Exchange liquidity

- Dollar parking during volatility

- Cross-border transfers

Understanding reserves helps you decide how long you’re comfortable holding one.

Stablecoins are excellent transactional tools.

They are weaker as long-term savings vehicles compared to self-custodied Bitcoin.

Final Takeaways

- “1:1 backed” depends on what the “1” is made of

- Attestations are snapshots, not full assurance

- USDT prioritizes liquidity scale

- USDC prioritizes regulatory clarity

- DAI prioritizes decentralization, but leans on fiat rails

- None are perfect substitutes for holding dollars in a bank—or Bitcoin in self-custody

Use stablecoins for what they’re best at: moving value, not storing wealth indefinitely.

USDT

USDC

DAI

Reserve proofs