The supplied web search results did not return any material relevant to Lingrid or DOGEUSDT; they reference device-location services (Google Find and Apple Find My). Proceeding without external sources, below is an analytical, journalistic introduction tailored to the requested topic.

Introduction:

As Dogecoin’s DOGEUSDT pair pauses after a forceful advance, traders and analysts are parsing whether the current pullback is a healthy consolidation or the prelude to deeper weakness. Against this backdrop, Lingrid’s retracement play has emerged as a structured response: a rules-based grid approach designed to capitalize on volatility during corrective phases of a bull run. Combining defined entry bands, staggered position sizing and predefined risk thresholds, the strategy reframes retracement not as a setback but as an opportunity to accumulate at systematically lower price points.

This piece examines the mechanics and market context of the Lingrid retracement play, juxtaposing technical signals – from mid-term moving averages and RSI divergence to Fibonacci retracement zones and volume profiles – with macro drivers that have fueled Dogecoin’s recent momentum.Rather than prescribing a one-size-fits-all outcome, the analysis highlights scenario-driven exits, breakeven targets and failure conditions, offering readers a pragmatic framework to evaluate whether a grid-based retracement strategy aligns with their risk tolerance and portfolio goals.

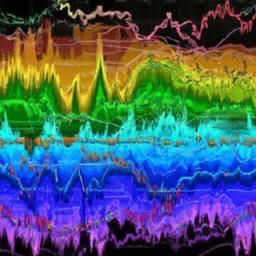

Lingrid order flow and liquidity heatmap signal an imminent DOGEUSDT retracement; prioritize staggered entry and risk limited accumulation

Order-flow metrics and the heatmap’s liquidity topology are flashing caution: concentrated ask walls along the recent highs coinciding with thinning bids beneath price suggest the market is primed for a corrective pullback rather than an immediate continuation. Execution reads show repeated micro-sweeps that pick off resting bids and create liquidity gaps – a textbook precursor to a retracement that can be sharp and fast. Trade discipline should prioritize staggered exposure and strict risk frameworks: begin with a small starter position, await a liquidity test to validate bid re-establishment, then scale in only as proofs of absorption appear.

- signal mix: ask concentration + bid depletion + sweep events

- Immediate implication: higher probability of a shallow-to-moderate retrace

- Core rule: favor phased sizing over single-entry commitment

For tactical execution, pair the heatmap read with a rule-based accumulation ladder and predefined exits – this converts a directional bias into a repeatable playbook. Below is a compact operational table you can overlay on intraday charts to manage entries, stops and partial profit-taking with disciplined sizing.keep position sizing conservative and cap incremental entries so total exposure remains risk-limited; treat each tranche as an independent trade with its own stop and target.

| zone | Action | Rationale |

|---|---|---|

| Immediate resistance | Trim/avoid new longs | High ask liquidity – likely bounce point |

| Accumulation band | Staggered buys (3-4 tranches) | Liquidity replenishment required for rally |

| Invalidation | Small stop / full cut | Clear breach signals structure failure |

- Execution tips: start light, add on confirmations, keep each tranche size limited to preserve capital.

Technical indicators and on chain flows confirm bull run exhaustion; recommend trimming leveraged exposure and deploying trailing stop criteria

Technical overlays and on‑chain metrics are painting a consistent picture of market fatigue across DOGE/USDT. Momentum oscillators exhibit bearish divergence from price-RSI failing to make new highs while price did, and the MACD histogram contracting-while volume-based indicators such as OBV have not confirmed the recent advance. Derivative signals add pressure: open interest has plateaued and funding rates have oscillated toward neutral/negative territory,a typical harbinger of diminished directional conviction. on‑chain flows reinforce the cautionary view: sustained exchange inflows, a spike in whale realizations following recent highs, and a slowdown in new active addresses all point to distribution rather than accumulation. Taken together, the market structure and the blockchain data converge toward an interpretation of a stretched rally that requires position risk management now, not later.

Practical risk steps should focus on de‑risking leveraged exposure and instituting dynamic exit mechanics. Recommended tactical measures include:

- Trim leveraged longs incrementally-consider taking 20-50% off the table on material pullbacks or when funding turns persistently negative.

- Reduce leverage to conservative multiples (e.g., under 3x) or close high‑leverage positions entirely while price is near recent peaks.

- Deploy trailing stops tied to volatility (ATR) or a percentage band-typical ranges for DOGE volatility are an 8-12% trailing stop, tightened to 5-8% after a failed retest.

- Monitor on‑chain triggers (net exchange inflows, whale spends, and open interest shifts) to scale further trimming or to re‑enter.

| Trigger | Threshold | Suggested Action |

|---|---|---|

| Funding Rate | Turns negative >24h | Trim 20-30% leveraged exposure |

| Open Interest | Decline >10% on down candle | Reduce leverage; tighten stops |

| Exchange Inflows | Spike vs 7‑day avg | Take profits; pause adds |

Defined risk capital strategy for opportunistic buyers targeting support clusters with volume confirmation before layering into the retracement

Position sizing and stop discipline drive this plan: allocate a fixed, predefined fraction of portfolio capital to each opportunistic entry (typical range 0.5-2% per setup) and place protective stops beneath the structural support cluster identified on the 4H-Daily overlap. Entries are only stacked after a volume-confirmation event – either a clear uptick in traded volume at the cluster, a bid-side absorption print, or a reclaim of a high-volume node – to avoid averaging into low-probability selloffs. Core rules to observe for every layer:

- Max risk per trade: 0.5-2% of equity.

- Starter size: 25-35% of intended position to test liquidity.

- Confirmation trigger: sustained volume > 20-30% above local average or a visible wick-fail reversal.

- Stop placement: below the support cluster or liquidity pocket, not arbitrary percent markers.

- Layer cadence: add remaining tranches only after confirmation or at progressively tighter risk profiles.

Concrete sizing examples and exit parameters keep the strategy repeatable; below is a tidy reference illustrating how position sizes scale with account risk for illustrative capital levels. Maintain a minimum target of 1.5:1 reward-to-risk on the aggregated position and predefine partial-take levels at measured retracement bands to lock gains and reduce tail risk.

| Account | Risk % | Risk $ | Starter % | Final position % |

|---|---|---|---|---|

| $10,000 | 1% | $100 | 30% | 100% |

| $50,000 | 1% | $500 | 25% | 100% |

| $100,000 | 0.75% | $750 | 25% | 100% |

- Exit guardrails: partial profits at first reclaim, tighten stops to breakeven after second tranche, full exit if volume confirms breakdown beneath cluster.

- Watchpoints: order-book thinning, sudden derivatives liquidations, and divergence between spot volume and exchange flows.

Insights and conclusions

As DOGEUSDT negotiates the post-bull-run landscape,Lingrid’s retracement play frames the market in probabilistic terms rather than certainties: a healthy pullback to key Fibonacci and moving-average levels would preserve the broader uptrend,while a failure to hold those supports could usher in a deeper correction or extended consolidation.Traders should look for confirmation – decisive closes through trendlines, volume expansion on directional moves, and corroborating momentum signals such as RSI and MACD – before committing capital.Risk management remains paramount in a market still prone to retail-driven spikes and narrative shifts; clearly defined stop-losses, conservative position sizing, and staged profit-taking can mitigate outsized losses from sudden volatility.On the macro side, Bitcoin’s price action, liquidity conditions, and news flow will continue to influence DOGE’s trajectory, underscoring the need to pair on-chain and technical observations with broader market context. Ultimately, Lingrid’s retracement framework offers a disciplined roadmap for those seeking to trade the pullback, but practitioners must remain adaptive: watch for signal confirmations, respect risk parameters, and be prepared to revise assumptions as new data arrives. This is not a prescription but a structured lens for assessing possibilities – one that will evolve alongside the market it seeks to read.