Note: the supplied web search results were unrelated to AVAX or chart analysis, so the introduction below is based on standard harmonic-pattern analysis and market-structure conventions.

Introduction - AVAX Bullish Gartley Identified

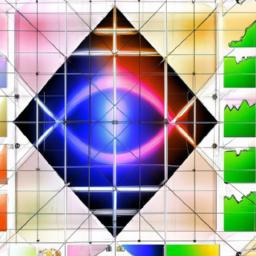

Technical scans have flagged a Bullish Gartley formation on AVAX,a development that could mark the end of the recent corrective phase and the start of a measured recovery for the Avalanche token. The Gartley – a classic harmonic pattern defined by specific Fibonacci relationships between four swing points (X‑A‑B‑C‑D) – is prized by traders for its capacity to identify high‑probability reversal zones. In this instance, the putative D pivot sits near the 78.6% retracement of the initial XA leg, aligning cleanly with the pattern’s textbook geometry and drawing attention from systematic and discretionary participants alike.

Analytically, the pattern’s signal strength will hinge on confirmation from momentum and volume metrics: bullish divergence on RSI or a bullish MACD crossover combined with an uptick in traded volume would elevate the probability of a enduring bounce. if validated, short‑term targets are likely to cluster at conventional fibonacci retracements of the AD leg (38.2% and 61.8%), with a more enterprising objective being a reclaim of the X level. Conversely, a decisive break below the X point would invalidate the setup and warn of resumed downside.

For market practitioners, the Bullish Gartley on AVAX offers a clear framework for entry, stop placement and staged profit-taking, but it should be weighted alongside broader on‑chain metrics and macro risk sentiment. Given crypto markets’ volatility, disciplined risk management and confirmation – rather than reliance on pattern recognition alone – remain essential for converting the pattern into repeatable trading outcomes.

AVAX Bullish Gartley Identified maps Fibonacci Confluence with Critical Support and Resistance Zones

The chart shows a classic harmonic Gartley aligning with multiple Fibonacci retracements and extensions, creating a high-probability reversal footprint. Price action has respected the primary swing structure: a B-point near the 0.618 retracement of the initial leg, a corrective C within the 0.382-0.886 band, and a D-target that projects the CD leg toward a 1.272 extension. This confluence sits squarely inside a broader demand area that has acted as support on higher timeframes, while overlapping intraday resistance forms a clear risk corridor above. Key technical markers to watch include:

- Fibonacci confluence: 0.618 / 0.786 / 1.272 cluster

- Volume confirmation: rising on the D-leg validation

- Momentum divergence: bullish RSI/MACD signals near the pattern completion

From a trade-management viewpoint,the setup favors a measured long bias with defined invalidation and tiered targets. Ideal entries are taken on a confirmed rejection at the D-zone or a retest with supportive microstructure, while protective stops should remain below the swing low that invalidates the harmonic alignment. Profit objectives can be scaled at conservative anchors such as the 0.382 and 0.618 Fibonacci extensions of the AD leg, with an optional run toward structural resistance if momentum accelerates.Practical rules:

- Entry signal: candle rejection or volume-backed breakout at D

- Invalidation: close below the pattern low

- targets: partial take-profits at 0.382, 0.618 extensions; trail into higher resistance

Momentum Indicators and Volume Patterns Validate the Gartley Structure for Short to Medium Term Upside

Momentum metrics are aligning in a way that bolsters the pattern’s bullish interpretation. Across timeframes RSI has formed a clear higher low against price, a classic bullish divergence, while MACD shows a recently completed bullish crossover with an expanding histogram – momentum shifting from contraction to expansion. Volume behavior corroborates the technical setup: advancing bars show volume expansion, corrective legs trace subdued volume, and a notable spike at the pattern’s completion point suggests increased buyer participation rather than a thin retracement. The convergence of these signals reduces the odds of a false breakout and shifts the risk-reward profile in favor of the upside.

- RSI: higher low vs. price (bullish divergence)

- MACD: bullish crossover + expanding histogram

- OBV / volume: rising on advances, muted on pullbacks

- Volume spike at pattern completion indicating conviction

When paired with the Gartley geometry, the momentum and volume ensemble validate a measured short-to-medium term target scheme while highlighting where risk controls should be placed. Preferred upside objectives sit near the initial Fibonacci exits – a near-term target at the 38.2% retracement and a more ambitious objective around the 61.8% level - with stops placed below the pattern invalidation zone to protect against structural failure. This alignment of trend, momentum and liquidity supports a tactical long bias, provided position sizing adheres to explicit risk parameters.

| Objective | Level | Rationale |

|---|---|---|

| Target 1 | 38.2% retrace | Early profit-taking on confirmed momentum |

| Target 2 | 61.8% retrace | Secondary objective if volume sustains |

| Stop | Below invalidation zone | Protects against pattern failure |

Tactical trading Framework with Precise Entry Zones Stop Loss Guidelines and Risk Adjusted Position Sizing

Precision matters: target the harmonic D zone-the confluence of the 0.618-0.786 XA retracement and a valid AB=CD completion-then wait for a high-probability price signal before committing. Use layered confirmation to reduce false entries: a clear rejection wick or bullish engulfing candle, rising volume on the bounce, and supporting momentum divergence on RSI or MACD. position risk by placing the stop just below the structure that invalidates the pattern - typically a few ticks below the X-point or the nearest swing low – and size entries relative to current ATR to avoid being stopped by normal volatility.

- Primary entry: D zone + price rejection candle

- Confirmation: volume spike or RSI divergence

- Stop placement: below X / swing low (ATR-adjusted)

- Partial scaling: scale out at the first target; trail remainder with ATR-based stop

Risk-adjusted sizing converts pattern conviction into position size and protects capital. Allocate risk as a percentage of portfolio equity (such as 0.5-2%), compute monetary risk from stop distance, then derive position size so that worst-case loss equals the chosen risk. Use a conservative scaling plan: take partial profits at the 0.382 and 0.618 Fibonacci extension levels, move the stop to breakeven after the first tranche, and let the remainder run with a trailing ATR stop to capture the extended bullish move.

| Risk | Stop (ATR) | Position size (% equity) |

|---|---|---|

| 0.5% | 0.8 × ATR | Small |

| 1.0% | 1.0 × ATR | Core |

| 2.0% | 1.5 × ATR | Aggressive |

Future Outlook

As AVAX traces out a textbook Bullish Gartley, the technical picture shifts from mere pullback to a potential reversal zone-one that demands close, disciplined monitoring. The pattern’s construction (with AB typically near a 61.8% retracement of XA and a D point often clustering around the 78.6% retracement of XA) provides a clear framework for traders: a defined entry zone, quantifiable targets and a tight stop-loss level beneath D. That clarity is precisely what separates speculative hope from repeatable trade planning.

Validation matters. For the Gartley to carry conviction beyond pattern recognition, market participants will look for confirmation in price action and volume-swift rejection of lower prices at the D area, rising buying momentum, and a break above local resistance with healthy participation. Short-term upside targets are commonly measured against Fibonacci pullback levels and nearby structural resistances; equally important is an assessment of risk-reward before committing capital.

Macro and on-chain context will also determine whether this technical setup translates into sustained gains. AVAX’s correlation with Bitcoin, broader crypto market liquidity, upcoming protocol updates or shifts in developer activity can all amplify or undermine a gartley-based rally. Traders and investors should therefore integrate technical signals with fundamentals and maintain disciplined position sizing.

In sum, the identification of a Bullish Gartley on AVAX raises a plausible case for a tactical reversal, but it is not a guarantee. Watch for price confirmation at the D zone, confirmatory volume and momentum, and external catalysts that could validate a larger trend change. As always, manage risk tightly and treat the pattern as one input among many in your decision-making process. This is not financial advice-stay informed and stay cautious.