As the U.S. economy faces growing uncertainty, questions about a potential recession are increasingly at the forefront of national discourse. Economic indicators, from fluctuating unemployment rates to shifts in consumer spending, have raised alarms among analysts and policymakers alike. In this article, we delve into the critical questions surrounding the possibility of a U.S. recession: What are the signs to watch for? How might a downturn affect consumers and businesses? And what measures can be taken to mitigate its impact? join us as we dissect the current economic landscape, providing clarity and insights into what lies ahead for the American economy.

Understanding the Economic Indicators Pointing Towards a Possible Recession

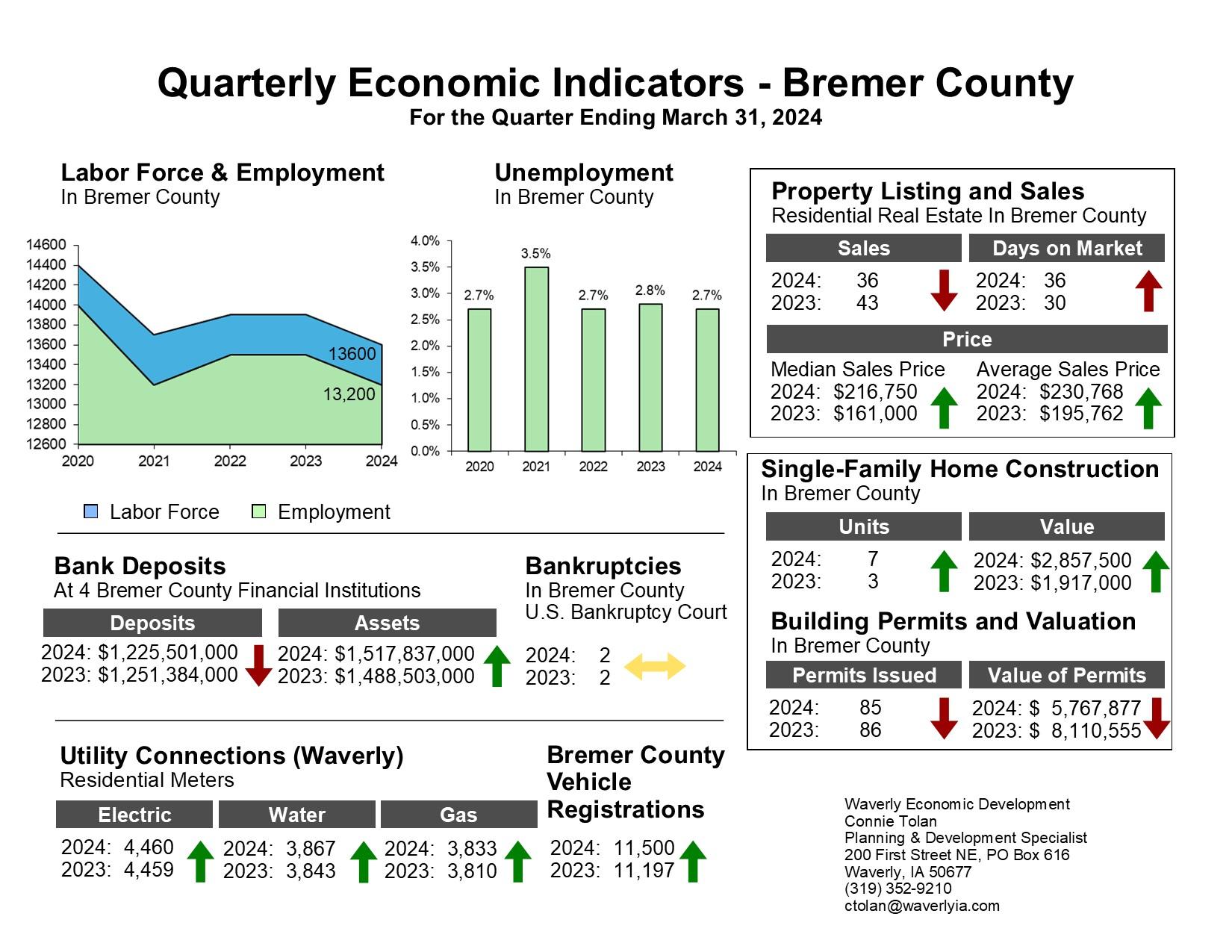

As fears of an impending recession loom large, analysts are meticulously monitoring several economic indicators that often hint at economic downturns. Key factors include declining consumer confidence, which signals reduced spending, and rising unemployment rates, both of which suggest a tightening economy. Furthermore, central banks are frequently adjusting interest rates to manage inflation, and sudden hikes can stifle growth.Specific metrics such as the yield curve inversion have historically been strong predictors of recessions, indicating that the market expects slower growth in the future.

Additional indicators like retail sales figures and manufacturing output serve as invaluable barometers for overall economic health. Notably, falling retail sales may suggest that consumers are cutting back, while manufacturing slowdowns can point to decreased demand for goods. A review of updated economic metrics reveals:

| Economic Indicator | Current Status | Implication |

|---|---|---|

| Consumer Confidence Index | Decreasing | Potential decline in consumer spending |

| Unemployment Rate | Rising | Indicates job market strain |

| Interest Rates | Increasing | May hinder economic growth |

| Retail Sales Growth | Declining | Signals lower consumer expenditure |

Each of these indicators provides critical insight into the potential trajectory of the economy. By closely monitoring these trends, stakeholders can make informed decisions, whether it’s adjusting financial strategies or preparing for shifts in market dynamics. understanding these indicators not only sheds light on the current economic landscape but also prepares investors and consumers alike for what lies ahead.

Evaluating the Impact of Fiscal Policies on the Current Economic Landscape

The ongoing debate surrounding fiscal policy has become a pivotal element in assessing the likelihood of a recession in the United States. As the Federal Reserve adjusts interest rates in reaction to inflation concerns, the ripple effects on consumer spending and business investments are becoming increasingly apparent. Key measures such as tax policies, government spending, and public debt levels play a meaningful role in shaping the economic landscape. Observers are focusing on how these fiscal strategies interact with prevailing market conditions and consumer sentiment, potentially leading to a contraction in economic activity if not managed effectively.

One notable aspect of current fiscal policies is their direct impact on liquidity and capital flows within the economy. The government’s efforts to stimulate growth through increased spending have prompted a mixed response from the private sector, leading to fluctuating confidence levels among investors and consumers alike. Critical indicators that analysts are monitoring include:

- Changes in unemployment rates

- Shifts in consumer confidence indices

- Trends in corporate investment

- Adjustments to interest rates and inflation measures

Informed projections are essential for anticipating potential shifts in economic conditions, as the balance between stimulative fiscal measures and rising inflationary pressures could determine the trajectory of the economy in the coming months. As policymakers navigate these challenges, the potential for a downturn remains a critical factor in discussions surrounding the nation’s economic resilience.

Strategies for Individuals and Businesses to Navigate Potential Economic Downturns

As the prospect of an economic downturn looms, both individuals and businesses must adapt their strategies to weather the potential storm. One effective approach is to diversify income streams. For individuals, this could mean exploring side hustles or freelance opportunities in addition to their primary job. Businesses should consider expanding their service offerings or exploring new markets to attract different customer segments. Cutting unnecessary expenses is also vital; reviewing subscriptions, renegotiating contracts, and minimizing overhead can free up resources that may be essential during tougher times.

Moreover, establishing a robust emergency fund can provide a safety net. Individuals should aim to save at least three to six months’ worth of living expenses, while businesses should ensure they have sufficient cash reserves to cover operational costs during revenue dip periods. Investing in financial literacy can also empower both consumers and companies to make informed decisions about investments and savings. Ultimately, being proactive and adaptable will enable individuals and enterprises to not just survive but potentially thrive amidst economic uncertainties.

In Retrospect

As we navigate the complexities of the current economic landscape, the potential for a U.S. recession looms large in the minds of policymakers and citizens alike. With interest rates rising, inflation persisting, and geopolitical tensions influencing market dynamics, concerns about a downturn are palpable. It is indeed crucial for individuals and businesses to stay informed and prepared for any shifts that may arise. While predictions vary, understanding the indicators and trends will better equip us to face the challenges ahead.As we monitor these developments closely,one key takeaway remains: vigilance and adaptability will be essential in the days to come. Stay informed, stay prepared, and let us collectively work toward fostering a resilient economy.